Q3 2024 Market Reports

Industrial

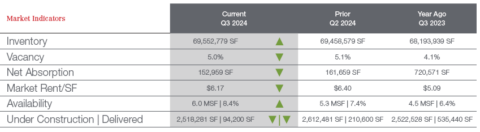

Slower consumer spending and plateauing retail sales have led to a decline in leasing activity heading into the final months 2024. And while supply has outpaced demand in the Columbia market in five of the past seven quarters, limited speculative construction has kept vacancy rates lower than the national average at 5.0%. While that has increased more than 160 basis points since hitting all-time lows in 2022, vacancies are well below historical norms.

View Full Industrial Report Here

Office

Market fundamentals in the Columbia office sector have stabilized heading into the final months of 2024. A handful of move-ins in the first half of the year have helped stabilize absorption after a negative 2023. Combined with limited new supply, the recovering absorption kept office vacancies here below the national average. However, some of the largest move-ins came from leases signed in 2023 or earlier, and leasing activity slowed in the first half of 2024 compared to the year prior.

Retail

While continued rent growth in the retail sector has held investor interest better than some property types as of the second half of 2024, frozen capital markets have still kept many deals from closing. In Columbia, roughly $191 million has traded over the past year, and trailing four-quarter investment volume was down more than two-thirds on a year-over-year basis and more than 50% since its peak in early 2022.