Q4 2024 Market Reports

Industrial

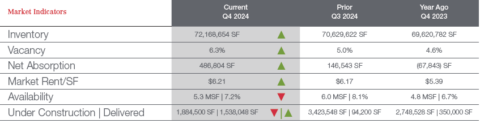

With vacancy rates up more than 200 basis points over the past two years, rent growth in Columbia has begun to cool. At 4.4% year over year, annual rent growth is still outpacing the national rate. However, a closer look at quarterly rent growth numbers signals a continued slowdown ahead. Rents rose just 0.3% in 24Q3, down from 1.9% in

23Q3 and a peak of 2.7% in 22Q1.

View Full Industrial Report Here

Office

At $19.15/SF Columbia’s office space comes at a significant discount when looking at comparable office markets in the region. The lack of supply pressure in the market has kept rents growing slightly faster than the national average at 1.2% annually. Slower leasing activity, however, has kept cooled rent growth below pre-pandemic trends when annual rent growth averaged roughly 3%.

Retail

Sales volume has remained slow across all property types in Columbia, though retail has held investor interest better than some other asset classes heading into 2025. The annual retail volume of roughly $179 million is less than half the peak in 2022. However, a handful of larger deals increased investment volume in the second half of 2024.